So far, 2018 has been pretty amazing. We've released two huge new features to the apps, we've taken home a really exciting award and things are in no danger of slowing down, because... ![]()

As of today, you can now whiz around the whole world with your WeSwap card. Yes!

WeSwap now works in any country, anywhere, wherever the Mastercard® Acceptance mark is displayed. Can we get a high five?

How does it work?

As well as being able to swap into any of our 18 existing currencies, you can now also use your home balance to spend almost anywhere in the world - from Fiji, to the Philippines, to Paraguay - and we’ll convert it for you on the spot. *stadium cheer*

All you need to do is load up your card with your home currency and spend. As it's an instant conversion, the fee is the same, transparent 2% fee as our instant swap. Simple.

For anywhere that uses one of our existing 18, you can either load up in ££ and go - or continue to swap in advance to get the best rates. This also means if you happen to forget to swap for any reason, your card will still work as long as you've got a balance in your home currency.

We hope this makes it easier to take your WeSwap card on even more journeys abroad. We seriously can’t wait to hear what you’ll get up to.

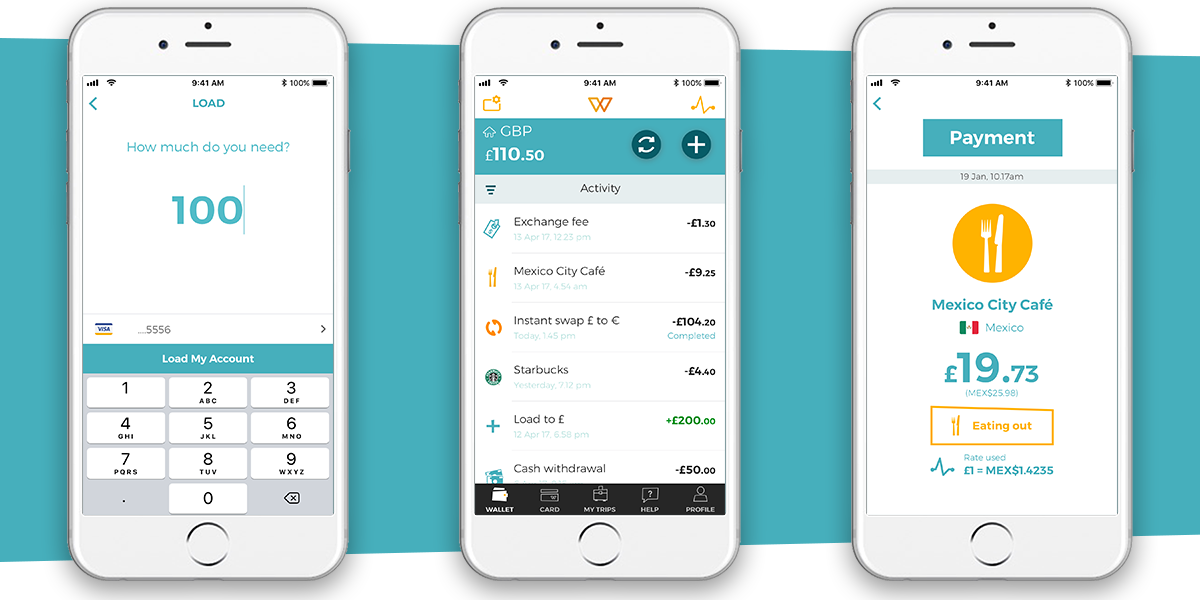

How do I see these transactions in my app?

They’ll all be listed clearly under your GBP wallet. When you spend in one of our non-wallet countries, the money will be deducted in GBP from your main wallet, and you’ll clearly see the fee in your activity list.

Is this better than using my bank card abroad, or getting cash from a bureaux?

In a word – yes. Most bank cards charge at least 3% for overseas transactions, not including any ATM fees or transaction fees, and the mark up on cash is typically even more than that. We've crunched what this means in real terms for you below, using Thai Baht for comparison.

These rates were checked on provider websites 10.03.2018 at 13:20.

You also don’t need to carry all those notes around with you, which is handy when exploring the unknown 👍

What happens if you have money in your home currency AND a foreign currency?

It will use the official foreign currency first, provided it's among the ones we support and you have funds. Otherwise you will be charged in your home currency.

What if you don't have enough foreign currency for the transaction - can it use both in one transaction?

One transaction will never be split into two currencies, so if you don't have enough in your currency wallet it will be taken from your home currency instead. And obviously, if there isn't enough in either, the transaction will decline. 😊

Do I need to update the latest version of the app to get this?

No, you don’t – it’ll automatically work with all versions. But we always recommend updating to the latest as we’re reacting to feedback and generally making things better.

Finally, a huge thanks to all our employees and community members involved in testing this release around the world. We couldn't have done it without you!

Know a friend who's going abroad? Share the good news!

[socialpug_tweet tweet="The WeSwap travel card now makes currency exchange cheaper worldwide 🌍💳"]

Tell us - where will you be going with WeSwap this year? Let us know on our Facebook and Twitter pages, we can't wait to hear what you'll get up to!

With ❤️, The WeSwap Team